What Makes Financial Stress So Overwhelming?

Let’s be honest—worrying about money doesn’t just live on spreadsheets. It hits you in the gut, keeps you awake at night, and follows you through your day like a low-humming alarm. Financial stress isn’t just about bills or balances; it’s about the fear of not being safe, not being enough, or falling behind.

It sneaks in through job insecurity, debt shame, social comparisons, and unexpected expenses. And the worst part? It can make you feel totally alone.

But the science says otherwise—and it also shows us how to fight back.

The Body-Mind Connection: Why Money Feels Like Danger

When financial stress strikes, your brain doesn’t distinguish it from a physical threat. Your heart races, your breath shortens, and cortisol floods your system. Over time, this leads to fatigue, anxiety, and even physical health issues.

This is why most advice like “just budget better” falls flat. If your nervous system is in survival mode, logic gets muted. What we need are tools that work with the brain, not against it.

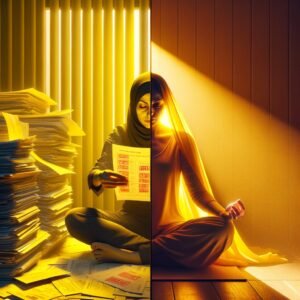

12 Real-World Strategies for Calming Money Anxiety

These strategies go beyond budgets. They’re about rewiring your relationship with money—emotionally, neurologically, and behaviorally.

1. Cognitive Budgeting

Think of this as therapy for your money habits. Instead of only tracking dollars, notice the why behind your spending. Was that $80 dinner about hunger—or about feeling seen? The goal is awareness, not restriction.

2. The 10-Minute Reset

Get hit with a surprise bill or financial panic? Before spiraling, step away. Set a timer for 10 minutes. Walk, breathe, reset. It interrupts the stress loop and gives your rational brain a chance to re-enter the chat.

3. Envelope Reset (with a Twist)

Revive the old envelope budgeting method—but go deeper. Label envelopes not just by expense, but by emotional intent: “Safety,” “Joy,” “Growth.” It’s like aligning your money with your soul.

4. Write It Out

Grab a notebook or app and journal about your money stress. Questions to explore:

What did my parents teach me about money?

When do I feel most financially insecure?

What am I avoiding?

The page becomes a mirror—and sometimes, a release valve.

5. Find Your People

There are free support groups (online and offline) for financial stress, debt anxiety, and emotional spending. Sharing your struggle rewires shame into solidarity. You’re not the only one feeling like this. Not even close.

6. Speak Small Truths

Talking about money doesn’t have to be all-or-nothing. Start small. “I’m feeling stressed about expenses lately.” Progressively disclose your reality with someone safe. Honesty clears emotional bandwidth.

7. Define Your ‘Enough.’

Not what Instagram says. Not what your friends have. What feels safe and satisfying to you? Create your own definition of “enough”—and watch comparison anxiety fade.

8. Schedule Your Debt Time

Don’t let debt stalk you 24/7. Create a specific time slot each week—say, Friday at 5pm—for looking at balances, making payments, and planning. The rest of the week, give yourself emotional permission to rest.

9. Clean Up Your Feed

Mute the influencers. Unfollow the lifestyle porn. If scrolling triggers inadequacy or spending pressure, it’s time to curate your online world. What you see affects how you feel—and how you spend.

10. Anchor Yourself with Mantras

Try saying:

“Money comes and goes. I stay grounded.”

“I’m resourceful, even when resources are low.”

Mantras interrupt catastrophizing thoughts and anchor your nervous system.

11. The Peace Fund

Even if it’s just $5/week, set up an automatic transfer into a savings account labeled something comforting—“My Calm,” “Safety Net,” “Sanity Jar.” It’s a tiny act of control in a chaotic world.

12. Meditate for Money Peace

Guided meditations on abundance or financial fear can actually shift your neural wiring. Ten minutes a day can retrain your brain to respond with clarity instead of panic.

FAQs:

Can money stress make me sick?

Absolutely. Chronic financial anxiety has been linked to sleep issues, weight gain, blood pressure spikes, and depression. The body holds the burden—even if the numbers live on a screen.

How fast do these strategies work?

Some tools, like breathing or journaling, offer relief instantly. Others—like shifting mindset or building savings habits—take weeks. But every step builds psychological momentum.

🧰 Products / Tools / Resources

You Need A Budget (YNAB) – a budgeting tool with emotional intelligence baked in

Simple Habit or Insight Timer – for guided meditations on stress

r/personalfinance – Reddit community with empathy and actionable advice

Books: The Psychology of Money by Morgan Housel, Scarcity by Mullainathan & Shafir

Apps like Cleo or Qapital – make saving feel less stressful and more game-like