The Mental Weight Few Acknowledge

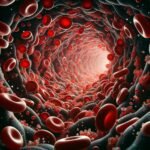

Debt doesn’t knock loudly at the door—it seeps in quietly, until it’s everywhere. It’s in your thoughts while you’re trying to fall asleep, in the pit of your stomach when your phone buzzes, and in the hesitation before swiping your card. It’s not just money owed—it’s mental real estate, and it’s expensive.

When Your Brain Feels Maxed Out

You Can’t Focus — And It’s Not Your Fault

If you’ve ever walked into a room and forgotten why, or reread the same email line five times, you’re not losing your edge—you’re drowning in mental noise. Debt hijacks working memory, the part of the brain responsible for short-term focus. With so much energy tied up in managing due dates, juggling expenses, and future-dreading, there’s little left for much else.

Decision-Making Turns Into a Minefield

Each financial decision—what to buy, what to skip—feels like playing chess blindfolded. You’re not indecisive, you’re overloaded. Constant trade-offs erode confidence and create a low-grade panic that stalls progress. So, you either freeze or make a rash call just to stop the spinning.

Emotional Turbulence Below the Surface

The Unexpected Anger, Snapping, and Shutting Down

Debt changes how you feel in your own skin. Maybe you’ve noticed your fuse is shorter. Or that you’ve started ghosting friends. Chronic financial stress messes with emotional regulation—it’s like being stuck in a room with the volume turned way up on every feeling, with no knob to turn it down.

The Quiet Shame No One Talks About

Here’s the cruel twist: the more you’re struggling, the less you’re likely to say a word. Because debt isn’t just a number—it feels like a character flaw. That sense of failure, of not measuring up, often leads people to isolate, precisely when they most need support.

The Trauma Loop That Keeps You Stuck

Always On Alert, Even When It’s Quiet

Living in debt trains your nervous system to be on edge—always. You might flinch at unexpected texts, fear checking your balance, or overreact to everyday bills. These aren’t overreactions; they’re trauma symptoms. Your brain thinks you’re under threat, because financially, you are.

The Guilt That Lingers Long After You Swipe

Even small purchases come with a side of self-reproach. It’s the inner voice whispering, “You shouldn’t have.” This guilt isn’t about extravagance—it’s emotional residue from feeling unsafe for too long. Over time, even basic needs feel like indulgences.

Building Peace One Step at a Time

Calming Your System First

You don’t need to solve everything today. Sometimes, just sitting still and taking five deep breaths is the win. Grounding techniques like these restore clarity and make emotional space for smart financial action. They’re not fluffy—they’re survival tools.

Budgeting That Feels Like Self-Respect

Forget rigid spreadsheets for a second. What if your budget included joy? A “no guilt” category for small comforts? Financial planning isn’t about punishment—it’s about reclaiming agency. A good plan should feel like an act of care, not control.

Tools, Support, and Permission to Breathe

You deserve both emotional healing and financial support. Start here:

National Foundation for Credit Counseling (NFCC) – Helps you build a practical, personalized debt strategy

Financial Therapy Association – Find professionals trained in both money and emotion

Debtors Anonymous – A safe space to share, recover, and rebuild

Mental Health America – Resources tailored to financial stress and its mental health impact

Products / Tools / Resources

📘 “Mind Over Money” by Brad Klontz — for reframing your money story

🧠 Calm app — guided meditations for anxiety and financial overwhelm

💳 YNAB (You Need a Budget) — budgeting software built around intention, not guilt

🤝 BetterHelp — affordable access to licensed therapists, including financial stress specialists

🔗 DebtorsAnonymous.org — anonymous, peer-led support rooted in shared experience